Venture Capital and Equality

Thomas Piketty’s 2013 best seller “Capital in the Twenty-First Century” made plenty of noise in the popular media. In his book, Piketty discusses the growing inequality between the very rich and the rest of the population. Although the book goes over many topics, the heavily reported part is the famous “r > g” equation, which states that the return on investment is greater than the growth rate. The logical conclusion is that the rich, which have money to invest, are getting richer at a faster rate than the general population.

I don’t believe this theory at all, and neither do most economists.

The theory, however, attempts to explain empirical facts. The rich are getting richer faster than the general population. Personally, as long as everyone is better off, I don’t actually see a problem with this.

Nonetheless, it is instructive to try and understand why this is happening.

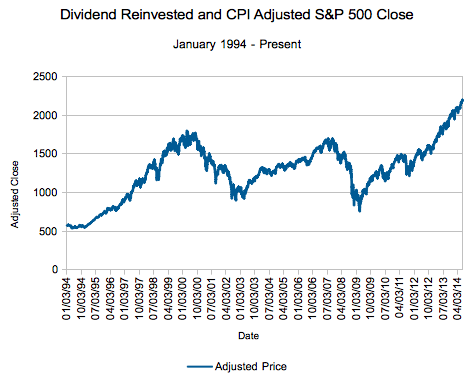

The average middle class investor (assuming she doesn’t waste all her salary on junk) can turn to the public markets as a means to increase her wealth. The most common benchmark is the S&P 500, presented below (click to reach the source).

Assuming all dividends are re-invested our investor got 6.86% annual returns on top of inflation for the twenty year period between 1994 and 2004. That’s not bad, although most investors won’t stomach 100% of their money in stocks.

I’m guessing the ultra wealthy can afford to go all stocks, but let’s ignore this for now.

The point I would like to talk about is that our imaginary investor only has access to the public markets. It would be practically impossible for her to buy stocks in the private market.

And the relationship between the public and private markets has been changing significantly in recent years, especially in the technology sector (and technology is eating the world, paraphrasing Mark Andreessen.)

In his excellent article on why “It’s Not 1999”, Ben Thompson provides an overview of the changing nature of the capital markets which leads to less and less IPOs:

- The most important has been the emergence of a new type of capital: growth capital. Growth capital is less speculative than traditional venture capital; it seeks to make relatively larger investments for relatively smaller stakes in companies with provably viable businesses that are seeking to grow for all of the reasons listed above. Now an IPO is no longer necessary for growth

- Secondary markets and special purpose vehicles that buy stock from founders and early employees give founders and early employees a way to realize some of their gains, again, without an IPO. This too removes a previous forcing condition for an IPO

- Finally, more and more early investors have determined that doubling down on winners often provides a better return than spreading bets widely; indeed, an increasing number of venture funds are explicitly marketed to limited partners as a combination of venture and growth capital

The result is that newer companies IPO – making their stocks available to the general public – at much later stages, after their rapid growth period is mostly over. See Uber for example. Let’s talk once they IPO.

In order to reap the benefits of the private companies, accredited investors invest in private companies. Instead of choosing specific startups and investing in them, diversification can be achieved by investing in a fund which in turn invests in a portfolio of startups. This fund is the famous Venture Capital fund.

The fees taken by VC funds from their LP, or Limited Partners, are high compared to traditional ETFs in the public markets. Typical management fees range from 2% for large funds to 2.5% for the smaller ones. These numbers pay for the ongoing work of the fund – salaries, legal work, and field work, among others.

Overall, VCs have much more work to do than fund managers investing in the public markets. Where a company listed in a stock exchange is required to provide information to the public, a private company has no such requirement. It is therefore the task of the VCs to do the due diligence work, background checks, etc., which legitimately increases expenses and hence the management fees.

In addition to the management fees, a percentage of the fund’s profits, usually 20% or higher, also stays within the VC fund and is not returned to the investors. This fee is meant to give the partners in the VC firm incentives which are aligned with the interests of their investors.

Even given all these fees, which are much higher than most actively managed funds investing in the public markets, returns are higher than “the market”. As someone who believes in a relatively efficient market (see A Random Walk Down Wall Street by Burton G. Malkiel) this merits a repeat. The VC funds generally beat the market.

If this is the case, then any rational investor would start investing in the private sector. The reasons they don’t, and why VC firms can have higher returns than the general market, is precisely because most investors can’t invest in the private market.

Generally speaking, only accredited investors can invest in private companies. While there are exceptions, most startups are better off refusing to accept money from non-accredited investors.

The requirements for becoming an accredited investor change by country. For the United States, the SEC states that one must meet one of the following:

- Have a net worth of one million dollars (excluding primary residence)

- Have an income of $200,000 each year for the last two years with the expectation to make the same amount for the current year

The requirements for Israeli investors are stricter. One must meet two of the following three criteria:

- Have a net worth of about three million dollars

- Have expertise in the capital markets (i.e. being employed in a relevant position for at least one year)

- Performed 30 transactions per quarter for the past year

Most people don’t qualify, and are thus left out of the ability to invest in fast growing startups.

One such woman was interviewed in episode #7 of The Startup podcast. She was prohibeted from investing in Gimlet Media who was fund raising in a crowd-funding site at the time. Crowd funding sites, such as OurCrouwd, are like kickstarter, except that instead of getting a T shirt, you get equity in the company raising the money.

In 2011 the Obama administration passed the Jumpstart Our Business Startups Act, or as it is more commonly known – the JOBS act. The regulatory changes are intended to ease restrictions on raising money in the private market.

Title III of the JOBS act will allow most middle class individuals to invest up to $2,000 or 5% (whichever is higher) in private companies via crowdfunding sites. This part of the JOBS is not yet in effect, allegedly due to pushback from consumer protection groups.

Much is still to be determined on how Title III going into effect in October will impact the general public. In particular, the fee structure of crowd funding sites serving the general public appear to be expensive, potentially eating into the excess returns achievable in the private market.

In the end, I believe that the attempts to protect individuals from themselves only lead to increased inequality. Allowing people the freedom to make their own choices, and make their own mistakes, would have allowed the general public to take part in the current growth.